Funding Government And State Owned Enterprises I - Introduction

The series deals with the following topics:

- Introductory brief.

- Pension funds.

- Funds regulated by the Registrar of Pension Funds.

- The Government Employees Pension Fund and other public sector funds not regulated by the Registrar of Pension Funds (1)

- The Government Employees Pension Fund and other public sector funds not regulated by the Registrar of Pension Funds (2)

- Funds other than pension funds which might be required to finance SOE’s

- Country comparisons (1).

- Country comparisons (2).

- Conclusion

Briefs 1 and 9 summarize the approach and findings, and they will be published first. Shortly thereafter, Briefs 2 to 5 will be published, and finally Briefs 6 to 8.

Introduction

This introductory brief considers aggregate assets in funds discussed in this series of briefs, the effects of prescribed assets in SA in the past, the potential cost to investors from prescribed assets going forward and rates of return on the different asset classes and their trends.

Aggregate fund assets

The most recent complete account of financial assets discussed in this brief series represents the position as at 31 December 2017.

|

R million |

|

|

FSB registered pension funds |

2 420 354 |

|

Non-FSB pension funds |

1 790 754 |

|

Collective investment schemes |

2 250 722 |

|

Life offices |

2 838 388 |

|

Total |

9 300 218 |

Aggregate assets at the end of 2017 (R 9.30 trillion) were double the gross domestic product (GDP) (R 4.65 trillion) in 2017.

What is at stake now is the re-introduction of prescribed assets as a means of channelling funds towards government and state owned enterprises. Prescribed assets are the percentage of retirement funds’ assets (and possibly of other institutional investors) that, by law, have to be allocated to certain government-approved instruments.

The effects of prescribed assets in SA in the past

The first time prescribed assets were introduced was in 1956 when the Pension Funds Act was promulgated. The prescribed assets in question were government bonds and the debt of state-owned enterprises.[1]The level of prescription rose until it peaked in 1977. After that it tapered off and prescribed assets were scrapped altogether in 1989.

At its height, the prescribed asset level was set at 75% for public investment commissioners and 33% for long-term insurers. The consequences for the savings industry varied over the decades, but ultimately it resulted in eroding investor wealth.

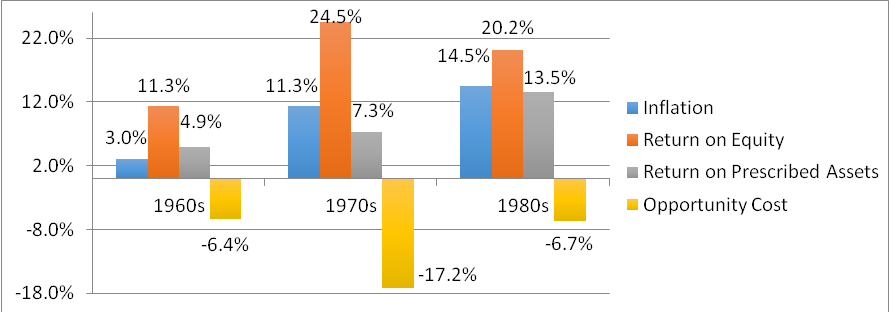

During the 1960s, when inflation was around 3%, prescribed assets gave a positive real return. But in the 1970s, inflation averaged 11% and, since the prescribed asset nominal return was 7%, a real return of negative 4%. During this time the stock market returned an average nominal return of 24.5% per annum, resulting in a 17.2% opportunity cost for the portion of the investment portfolios forced into prescribed assets instead of the stock market. In the 1980s inflation averaged 14.5%, the real return for prescribed assets was negative 1%, and the opportunity cost of not investing in the stock market was 6.7%.[2] This is shown graphically below:

With regards to the effect the policy had on asset allocation, around 40% of pension fund assets were in prescribed assets in the mid-to-late 1980s.

In 1988 the Jacobs Committee was appointed to investigate prescribed assets and associated market distortions, with the Committee ultimately recommending that the policy be scrapped.[3] After the policy was abolished in 1989 the allocation to government bonds and SOE debt fell with a shift towards equities. The allocation to government bonds and SOE debt is currently near 20%.

Potential capital levy resulting from prescribed assets going forward

Since 2004, the average return for equities represented by the JSE All Share Index has been 18% per annum, whereas the All Bond Index returned 9% per annum.[4]

To illustrate the diminished returns that could occur over 10 years as a result of prescribed assets, the HSF has created a capital levy spreadsheet/Excel model. This model consists of a portfolio of equities and government bonds, and calculates the resulting capital levy (the net present value of the diminished return, i.e the cost of complying with prescribed assets obligations) as a percentage of total investments. Using mid-market inputs in the left-hand-side table below, we get 10 year capital levies as per the three different percentages of prescribed assets shown on the right:

|

Inflation rate |

5.0% |

Percentage Prescribed |

Capital Levy - 10 years |

|

Bond coupon |

6.5% |

25% |

4.30% |

|

Equity dividend |

2.5% |

50% |

8.60% |

|

Real Equity return |

4.0% |

75% |

12.90% |

|

Nominal equity return |

9.20% |

||

|

Real discount rate |

4.00% |

||

|

Nominal discount rate |

9.20% |

||

|

Annual increase in share price |

6.70% |

||

|

Annual increase in bond price |

2.54% |

To download the capital levy spreadsheet/Excel model with its adjustable inputs, click here.

Rates of return on the different asset classes and their trends

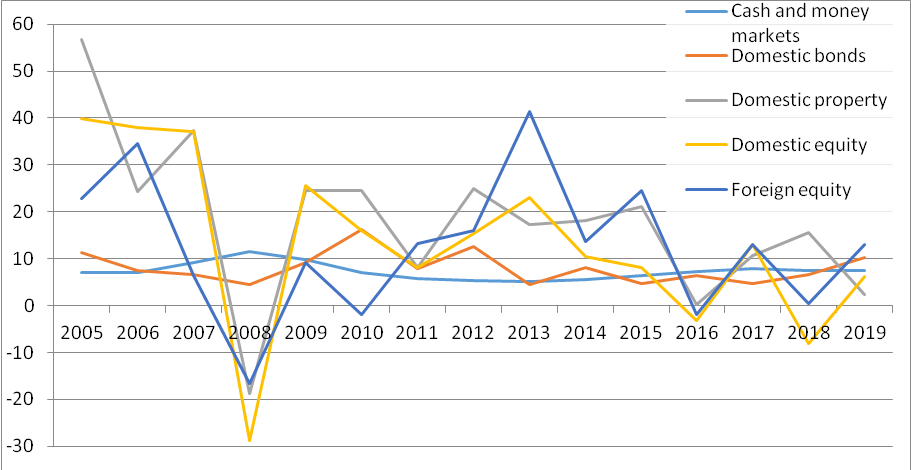

Overall the rates of return for all assets classes have trended downwards in the last fifteen years, with domestic equities and domestic property in particular feeling the pinch.

Annual percentage return per asset class from October 2005 to October 2019:

Percentage returns over the last 5, 10 and 15 years have been:

|

5 Year |

10 Year |

15 Year |

|

|

Cash and money markets |

7.3 |

6.5 |

7.3 |

|

Domestic bonds |

6.5 |

8.1 |

8.0 |

|

Domestic property |

2.0 |

9.9 |

13.8 |

|

Domestic equity |

2.9 |

8.5 |

11.9 |

|

Foreign equity |

8.7 |

13.7 |

11.5 |

Note that rand returns on foreign equity depend on the dollar/rand exchange rate as well as returns in dollar terms. At times when the exchange rate is depreciating, rand returns on foreign investments are increased.

Conclusion

The investment limitations that currently exist for pension fund managers, which will be covered in the following briefs are, the HSF suggests, in the best interest of beneficiaries in that they avoid the risk of over-concentration of any single asset class. But prescribing assets has in the past proven to be detrimental to fund performance, and going forward it is likely to detract from portfolio returns.

The trend in all asset returns has been downwards for some time now and especially so for local assets. And while extrapolating past returns is generally a poor indicator for future returns, the general consensus among market participants world-wide now is that economic growth levels globally are likely to be on the downside for the immediate future. Major markets which have been driving growth in recent history, namely China and India, are cooling off, coupled with the damage caused by the ongoing uncertainty about trade regimes, Brexit and geopolitical tensions in the Middle East. Locally, the challenges to the economy are well known to the average South African. Adding further downward pressure by re-introducing prescribed assets will only exacerbate the difficulties fund managers currently face in generating sufficient returns to secure beneficiary payments in defined benefit funds and adequate income replacement from defined contribution funds.

Charles Collocott

Policy Researcher

charles.c@hsf.org.za

[1]https://www.moneyweb.co.za/news/south-africa/anc-still-eyeing-pension-assets/

[3]https://www.iol.co.za/personal-finance/investments/opinion-prescribed-assets-lessons-from-the-past-20092007

[4]Nedbank CIB Fixed Income Insight, 18 January 2019, p4.